UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Securities Exchange Act of 1934

(Amendment No. )

____________________________________________

Filed by the Registrant. ý Filed by a Party other than the Registrant. ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | ||||

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

ý | Definitive Proxy Statement | ||||

¨ | Definitive Additional Materials | ||||

¨ | Soliciting Material under § 240.14a-12 | ||||

Facebook, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ý | No fee required. | |||||||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||

| (1) | Title of each class of securities to which transaction applies: | |||||||

| (2) | Aggregate number of securities to which transaction applies: | |||||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |||||||

| (4) | Proposed maximum aggregate value of transaction: | |||||||

| (5) | Total fee paid: | |||||||

| ¨ | Fee paid previously with preliminary materials. | |||||||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||

| (1) | Amount Previously Paid: | |||||||

| (2) | Form, Schedule or Registration Statement No.: | |||||||

| (3) | Filing Party: | |||||||

| (4) | Date Filed: | |||||||

| ||||||||

Mark Zuckerberg Chairman and Chief Executive Officer  Robert M. Kimmitt Lead Independent Director | To Our Shareholders | |||||||

You are cordially invited to attend the 2021 Annual Meeting of Shareholders (Annual Meeting) of Facebook, Inc. to be held on May 26, 2021, at 10:00 a.m. Pacific Time. The Annual Meeting will be a completely virtual meeting of shareholders conducted via live audio webcast to enable our shareholders to participate from any location around the world that is convenient to them. You will be able to attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/FB2021. The matters expected to be acted upon at the Annual Meeting are described in detail in the accompanying Notice of Annual Meeting of Shareholders and proxy statement. You may cast your vote over the internet, by telephone, or by completing and mailing a proxy card to ensure that your shares will be represented. Your vote by proxy will ensure your representation at the Annual Meeting regardless of whether or not you attend. Returning the proxy does not deprive you of your right to attend and vote your shares electronically at the Annual Meeting. Thank you for your continued investment in Facebook. | ||||||||

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 26, 2021: THIS PROXY STATEMENT AND THE ANNUAL REPORT ARE AVAILABLE AT www.proxyvote.com | ||||||||

A Message from Our Lead Independent Director

Fellow Shareholders,

First and foremost, I hope that you and your loved ones are safe and well in these unusual times.

On behalf of Facebook's board of directors, I would like to share some thoughts with you about your board’s oversight and key areas of focus over this unforgettable past year, my first as Lead Independent Director. Facebook's primary focus in this pandemic year has been to ensure the welfare and continuity of support for our employees and contractors, as well as the millions of small businesses and our community of over three billion people who use our products and services each day.

As stewards of the company, your board looks out for the interests of shareholders and that commitment remains steadfast. We also are dedicated to seeing that Facebook continues to innovate and embrace opportunities to act responsibly as a corporate citizen so that our business has a positive impact for all of our stakeholders.

Supporting employees and communities during the COVID-19 pandemic

Throughout the pandemic, our services have helped people stay connected with family and friends, as well as with customers and business partners, and find much-needed community and support no matter the physical distance.

Facebook helped health authorities around the world reach more than 2 billion people with accurate information about the coronavirus, while removing more than 12 million pieces of content on Facebook and Instagram containing misinformation that could lead to imminent physical harm.

We offered direct financial assistance to small businesses, a segment that was particularly hard hit during the pandemic. We committed $100 million to help up to 30,000 small businesses globally and $100 million specifically to support Black-owned businesses, Black creators, and nonprofits supporting the Black community in the United States.

I continue to be impressed by the resilience and dedication of Facebook’s teams around the world. Overnight, we were forced to move substantially all of our workforce to a remote work environment. We have supported our employees with this transition through help with childcare and other costs and introducing new leave policies to help employees care for sick relatives.

Supporting the growth of our business

The events of 2020 introduced a number of unforeseen challenges, contributing to a unique operating environment. Nevertheless, Facebook achieved strong annual results, including 22% revenue growth year-over-year. The results reflect a robust digital economy and the value Facebook provides to millions of businesses who use our services to reach consumers and generate sales.

We recognize that relentless focus on innovation is key to continued success. In 2020, we launched new products and experiences for consumers and business, and we added over 13,000 new employees, mostly in product and technology roles. We also made key leadership hires this year, including our Chief Product Officer, who re-joined the company, as well as hiring our first Vice President of Civil Rights and a new Chief Compliance Officer.

Board engagement and oversight

The full board was actively engaged with management on our most important issues. We reviewed the company’s product and business strategies and received regular briefings from management on policy, litigation, and regulatory matters. We also met as often as necessary to discuss ongoing developments related to the global pandemic.

Our independent board committees were active throughout the year, helping to oversee compliance, cybersecurity, finance and accounting, internal audit, executive compensation and performance, governance, and other matters. In May 2020, we also established a new privacy committee to help oversee the company’s privacy program, as well as to help oversee compliance with our obligations under our modified consent order with the U.S. Federal Trade Commission. In February 2021, we expanded the remit of the audit & risk oversight committee to incorporate oversight of environmental sustainability and our social responsibility as a company, including continued oversight of the safety and security of our community.

Board composition and leadership

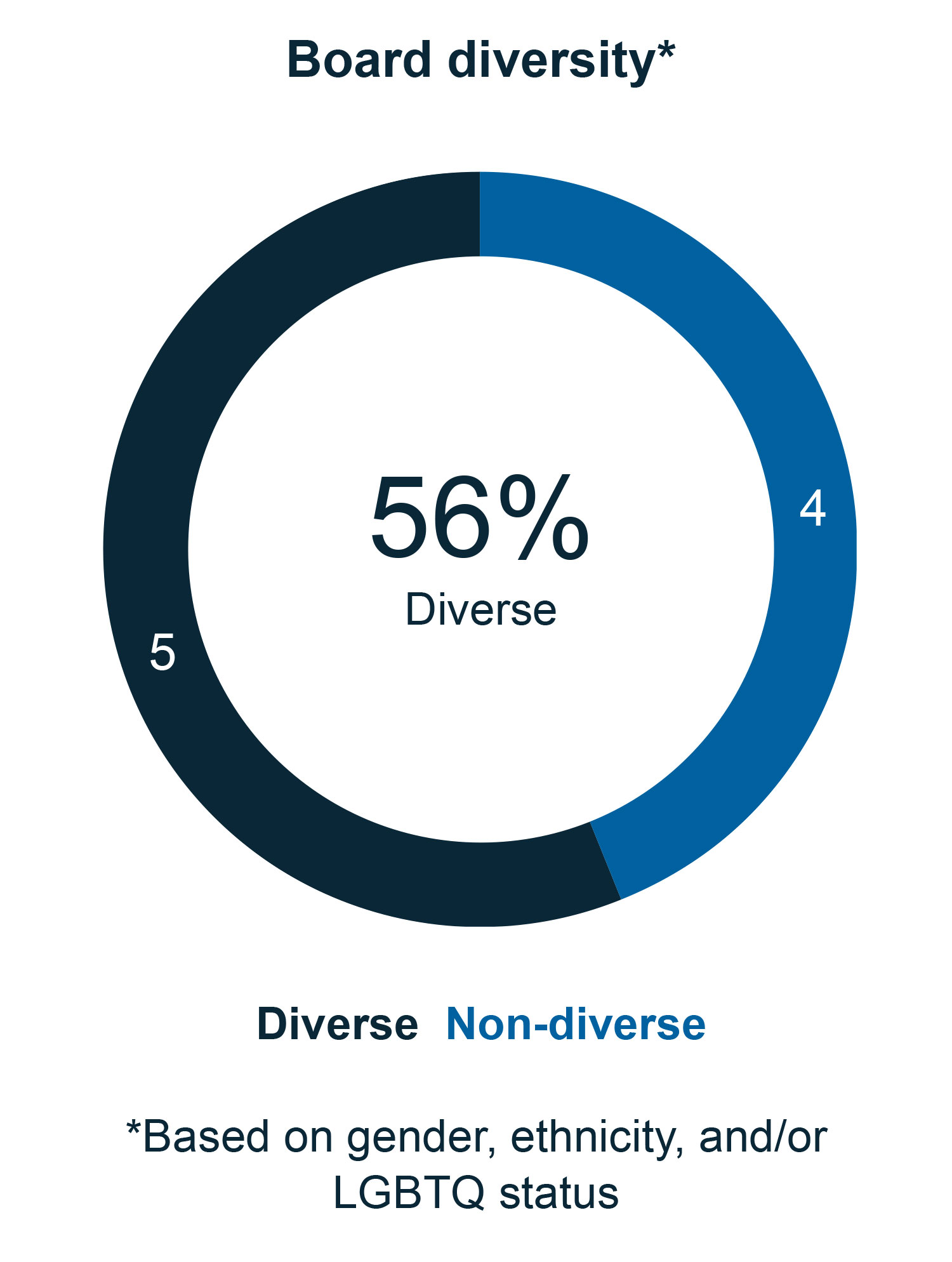

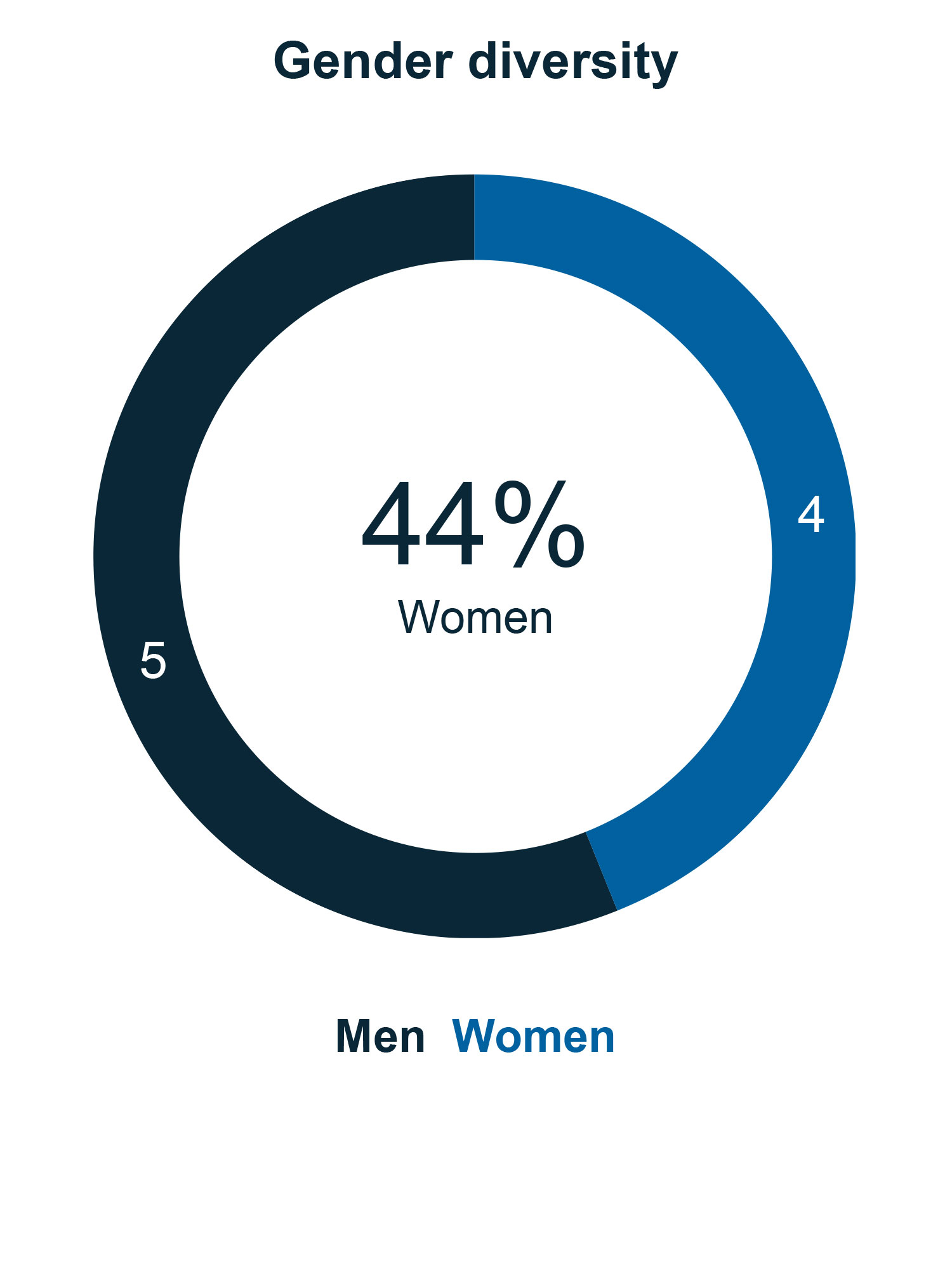

As a board, we are committed to seeing Facebook improve and succeed. In 2020, the company added four new independent directors: Andrew W. Houston, Nancy Killefer, Tracey T. Travis, and myself. The board is now comprised of nine members, seven of whom are independent. Each of our board committees is composed entirely of independent directors, and we have a healthy mix of newer and more tenured directors. We are proud that a majority of our directors are diverse in terms of gender, ethnicity, and LGBTQ status.

Representing the views of shareholders and doing so with a strong, independent voice is one of the reasons I joined this board, and I take my role as a conduit between Mark Zuckerberg and both our shareholders and independent directors very seriously. Facebook has structured the authority and responsibility of my role as Lead Independent Director to mirror closely the authority and responsibilities of Mark as Chairman. I meet regularly and work closely with Mark, coordinating board meeting agendas, providing feedback, and sharing recommendations of the independent directors with him after each executive session. He actively solicits our views and is very open to our feedback and recommendations.

Furthering our company principles

Facebook is committed to pursuing its company principles as described beginning on page 28 of this proxy statement. The company has set new goals to pursue these principles, including ESG initiatives in areas such as diversity and environmental sustainability.

We set a goal to increase the representation of people of color in leadership positions at Facebook in the United States by 30%, including a 30% increase in the representation of Black people in leadership, by 2025. We also set aggressive goals for 2020 and beyond for our global operations to achieve net zero greenhouse gas emissions and be 100% supported by renewable energy, and are aiming to reach net zero greenhouse gas emissions across our value chain by 2030. For more information on our progress in these areas, I encourage you to read our annual reports about our diversity and sustainability efforts, as well as our new corporate human rights policy.

Throughout the year, we engaged with a significant portion of our shareholders regarding corporate governance, important environmental and social issues, our operating and financial performance, strategy, and products. We welcome input from our shareholders and are committed to maintaining an active dialogue and soliciting feedback on our efforts.

I hope this first-ever message from the Lead Independent Director has been informative and useful to you. I join my fellow board members and the management team in thanking you for your continued support of and investment in Facebook.

Sincerely,

Robert M. Kimmitt

Notice of Annual Meeting of Shareholders to be held on May 26, 2021

To Our Shareholders

NOTICE IS HEREBY GIVEN that the 2021 Annual Meeting of Shareholders (Annual Meeting) of Facebook, Inc. will be held on May 26, 2021, at 10:00 a.m. Pacific Time. The Annual Meeting will be a completely virtual meeting of shareholders conducted via live audio webcast. You will be able to attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/FB2021.

We are holding the Annual Meeting for the following purposes, which are more fully described in the proxy statement accompanying this Notice:

•To elect the following nine directors, all of whom are currently serving on our board of directors, each to serve until the next annual meeting of shareholders and until his or her successor has been elected and qualified, or until his or her earlier death, resignation, or removal:

Peggy Alford

Marc L. Andreessen

Andrew W. Houston

Nancy Killefer

Robert M. Kimmitt

Sheryl K. Sandberg

Peter A. Thiel

Tracey T. Travis

Mark Zuckerberg

•To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021.

•To approve an amendment to the director compensation policy.

•To consider and vote upon six shareholder proposals, if properly presented.

•To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the proxy statement accompanying this Notice.

Only shareholders of record at the close of business on April 1, 2021 are entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. The Notice of Internet Availability of Proxy Materials (Notice), proxy statement and form of proxy are being distributed and made available on the internet on or about April 9, 2021.

By Order of the Board of Directors,

Whether or not you expect to attend the Annual Meeting, please vote at your earliest convenience by following the instructions in the Notice of Internet Availability of Proxy Materials or the proxy card you received in the mail.

Table of Contents

| Page No. | ||||||||

CORPORATE GOVERNANCE | ||||||||

| COMPENSATION AND SECURITY OWNERSHIP | ||||||||

PROPOSALS TO BE VOTED ON AT THE ANNUAL MEETING | ||||||||

| INFORMATION ABOUT THE ANNUAL MEETING | ||||||||

Proxy Statement Summary

This proxy statement summary highlights information described in more detail elsewhere in this proxy statement and does not contain all of the information you should consider. Please read the entire proxy statement before voting.

| ANNUAL MEETING OF SHAREHOLDERS | ||||||||||||||||||||

Date and Time May 26, 2021 10:00 a.m. Pacific Time | Place The Annual Meeting will be a completely virtual meeting of shareholders conducted via live audio webcast. You will be able to attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/FB2021. | Record Date April 1, 2021 | ||||||||||||||||||

Only holders of record of our Class A common stock and Class B common stock at the close of business on April 1, 2021, the record date, will be entitled to vote at the Annual Meeting of Shareholders (Annual Meeting). Holders of our Class A common stock are entitled to one vote for each share held as of the record date. Holders of our Class B common stock are entitled to ten votes for each share held as of the record date. Holders of our Class A common stock and Class B common stock will vote together as a single class on all matters described in this proxy statement.

To participate in the Annual Meeting, you will need the 16-digit control number included on your Notice of Internet Availability, proxy card, or voting instruction form. The Annual Meeting will begin promptly at 10:00 a.m. Pacific Time on May 26, 2021. We encourage you to access the virtual meeting website prior to the start time. Online check-in will begin at 9:45 a.m. Pacific Time, and you should allow ample time to ensure your ability to access the meeting.

Technicians will be available to assist you if you experience technical difficulties accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call 844-986-0822 (domestic) or 303-562-9302 (international) for assistance.

VOTING MATTERS AND RECOMMENDATIONS

The following table provides summary information about the proposals to be voted on at the Annual Meeting. See the pages of this proxy statement listed below for more information.

| Proposal | Board Voting Recommendation | Page Reference | ||||||

| Management Proposals: | ||||||||

1. The election of nine directors | FOR each nominee | 63 | ||||||

2. The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021 | FOR | 64 | ||||||

3. The approval of an amendment to the director compensation policy | FOR | 65 | ||||||

| Shareholder Proposals: | ||||||||

4. A shareholder proposal regarding dual class capital structure | AGAINST | 70 | ||||||

5. A shareholder proposal regarding an independent chair | AGAINST | 72 | ||||||

6. A shareholder proposal regarding child exploitation | AGAINST | 74 | ||||||

7. A shareholder proposal regarding human/civil rights expert on board | AGAINST | 77 | ||||||

8. A shareholder proposal regarding platform misuse | AGAINST | 80 | ||||||

9. A shareholder proposal regarding public benefit corporation | AGAINST | 82 | ||||||

OUR DIRECTOR NOMINEES

The following table provides summary information about our director nominees. See the sections of this proxy statement entitled "Directors and Executive Officers" and "Corporate Governance" for more information.

| Name | Director Since | Occupation | Independent | AROC | CNGC | PC | ||||||||||||||

| Peggy Alford | 2019 | Executive Vice President, Global Sales, PayPal Holdings | ü | |||||||||||||||||

| Marc L. Andreessen | 2008 | Co-founder & General Partner, Andreessen Horowitz | ü | |||||||||||||||||

| Andrew W. Houston | 2020 | Co-founder and Chief Executive Officer, Dropbox | ü | |||||||||||||||||

| Nancy Killefer | 2020 | Retired Senior Partner, McKinsey & Company | ü | |||||||||||||||||

| Robert M. Kimmitt | 2020 | Senior International Counsel, WilmerHale | LID | |||||||||||||||||

| Sheryl K. Sandberg | 2012 | Chief Operating Officer, Facebook | ||||||||||||||||||

| Peter A. Thiel | 2005 | President, Thiel Capital | ü | |||||||||||||||||

| Tracey T. Travis | 2020 | Executive Vice President and Chief Financial Officer, The Estée Lauder Companies | ü | |||||||||||||||||

| Mark Zuckerberg | 2004 | Founder, Chairman and Chief Executive Officer, Facebook | ||||||||||||||||||

| AROC | Audit & Risk Oversight Committee | LID | Lead Independent Director | ||||||||

| CNGC | Compensation, Nominating & Governance Committee | Committee member | |||||||||

| PC | Privacy Committee | Committee chair | |||||||||

HIGHLIGHTS OF ESG AT FACEBOOK | ||||||||||||||||||||

Net Zero Emissions Our goal for 2020 and beyond is for our global operations to achieve net zero greenhouse gas emissions and be 100% supported by renewable energy. We have also set a goal to reach net zero greenhouse gas emissions across our value chain in 2030. | Sustainable Facilities We prioritize water stewardship, and as a result, our data centers are over 80% more water efficient than the average data center. We also leverage rigorous sustainable design standards so that our facilities are constructed with responsible materials, utilize natural daylight, and are energy and water conscious. | Climate Science Information We have launched the Climate Science Information Center on Facebook in 16 countries to connect people with science-based news, authoritative information, and actionable resources from more than 250 partners around the world. | ||||||||||||||||||

Workforce Diversity Our goals are to have 50% of our workforce made up of underrepresented populations by 2024, to double the number of women employees globally and Black and Hispanic employees in the United States from 2019 to 2024, and to increase the representation of people of color in leadership positions in the United States, including Black leadership, by 30% from 2020 to 2025. | Pay Equity We have conducted pay equity analyses for many years, and continue to be committed to pay equity. In 2020, we announced that our analyses indicate that we continue to have pay equity across gender globally and race in the United States for people in similar jobs, accounting for factors such as location, role, and level. | Community Standards We publish quarterly Community Standards Enforcement Reports that track our progress on enforcing our content policies. We have also established and empowered an independent Oversight Board to review certain of our most difficult content decisions. | ||||||||||||||||||

Charitable Giving Tools Our charitable giving tools allow our community to come together quickly to raise money for causes they care about and in times of need. In total, people have raised over $5 billion on Facebook for nonprofit and personal causes around the world. | Helping Small Businesses In 2020, we announced a $100 million grant program to help small businesses around the world impacted by the pandemic. We also announced our investment of $100 million in Black-owned small businesses, Black creators, and nonprofits that serve the Black community in the United States. | Supporting Elections We work to support elections around the world and estimate that we helped more than four million people register to vote in the 2020 U.S. elections through the Voting Information Center on Facebook and Instagram. | ||||||||||||||||||

Board Independence Seven out of our nine director nominees are independent. All members of our standing committees are independent. | Lead Independent Director As our Lead Independent Director, Ambassador Robert M. Kimmitt plays a significant and meaningful role in leading our board of directors. | Board Diversity We were one of the first major companies to adopt a board diversity policy, and a majority of our directors are diverse in terms of gender, ethnicity, and LGBTQ status. | ||||||||||||||||||

Audit & Risk Oversight Committee Audit & risk oversight committee responsibilities include overseeing our major risk exposures, including in the areas of financial and enterprise risk, legal and regulatory compliance, environmental sustainability, social responsibility, and cybersecurity. | Compensation, Nominating & Governance Committee Compensation, nominating & governance committee responsibilities include succession planning, as well as evaluating and having sole authority to recommend nominees to our board of directors and candidates for membership on our privacy committee. | Privacy Committee Privacy committee responsibilities include overseeing our privacy program and risks related to privacy and data use. | ||||||||||||||||||

See the sections of this proxy statement entitled "Corporate Governance" and "ESG at Facebook" for more information about our efforts across these and other environmental, social, and governance areas.

NOTE ABOUT FORWARD-LOOKING STATEMENTS

This proxy statement contains forward-looking statements. All statements contained in this proxy statement other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives for future operations, are forward-looking statements. The words "believe," "may," "will," "estimate," "continue," "anticipate," "intend," "expect," and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including those described in our Annual Report on Form 10-K for the year ended December 31, 2020. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In addition, some of our sustainability goals, in particular those related to environmental matters, are based on estimates and assumptions that may turn out to be inaccurate. Similarly, our workforce diversity goals are stretch goals whose achievement, while uncertain, drive and inspire us to make progress. In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this proxy statement may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

INFORMATION REFERENCED IN THIS PROXY STATEMENT

The content of the websites referred to in this proxy statement are not deemed to be part of, and are not incorporated by reference into, this proxy statement.

Directors and Executive Officers

The following section provides information regarding our directors, director nominees, and executive officers as of April 9, 2021. Our executive officers are designated by, and serve at the discretion of, our board of directors. There are no family relationships among any of our directors or executive officers.

DIRECTORS

Mark Zuckerberg - Chairman and Chief Executive Officer | ||||||||

Director Since: 2004 Age: 36 | Experience: Facebook, Inc. Founder & Chief Executive Officer (2004-present) Chairman of the board of directors (2012-present) | Other Public Company Directorships: None Former Public Company Directorships Held in the Past Five Years: None Education: Attended Harvard University (studied computer science) | ||||||

Qualifications: We believe that Mr. Zuckerberg should serve as a member of our board of directors due to the perspective and experience he brings as our founder, Chairman, and CEO, and as our largest and controlling shareholder. | ||||||||

Sheryl K. Sandberg - Director and Chief Operating Officer | ||||||||

Director Since: 2012 Age: 51 | Experience: Facebook, Inc. Chief Operating Officer (2008-present) Google, Inc. Various positions, including Vice President, Global Online Sales & Operations (2001-2008) U.S. Department of the Treasury Chief of Staff (1999-2001) Senior Advisor to Deputy Secretary (1996-1999) McKinsey & Company Consultant (1995-1996) The World Bank Economist (1991-1993) | Other Public Company Directorships: SurveyMonkey (SVMK Inc.) Former Public Company Directorships Held in the Past Five Years: The Walt Disney Company Education: Harvard University (A.B. in economics) Harvard Business School (M.B.A.) | ||||||

Qualifications: We believe that Ms. Sandberg should serve as a member of our board of directors due to the perspective and experience she brings as our COO, as well as her service on other boards of directors. | ||||||||

Peggy Alford - Independent Director | ||||||||

Director Since: 2019 Age: 49 | Experience: PayPal Holdings, Inc. (digital payments company) Executive Vice President, Global Sales (2020-present) Senior Vice President, Core Markets (2019-2020) Various other positions (2011-2017) Chan Zuckerberg Initiative (philanthropic organization) Chief Financial Officer & Head of Operations (2017-2019) Rent.com (an eBay Inc. company) President & General Manager (2007-2011) Chief Financial Officer (2005-2009) eBay Inc. Marketplace Controller and Director of Accounting Policy (2002-2005) | Facebook Committees: Audit & Risk Oversight Privacy Other Public Company Directorships: The Macerich Company Former Public Company Directorships Held in the Past Five Years: None Education: University of Dayton (B.S. in accounting and business administration) | ||||||

Qualifications: We believe that Ms. Alford should serve as a member of our board of directors due to her extensive leadership, business, and compliance experience, as well as her experience with finance and product development. | ||||||||

Marc L. Andreessen - Independent Director | ||||||||

Director Since: 2008 Age: 49 | Experience: Andreessen Horowitz (venture capital firm) Co-founder & General Partner (2009-present) Opsware, Inc. (formerly known as Loudcloud Inc.) Co-founder & Chairman of the board of directors (1999-2007) America Online, Inc. Chief Technology Officer (1999) Netscape Communications Corporation Co-founder & various other positions, including Chief Technology Officer & Executive Vice President of Products (1994-1999) | Facebook Committees: Compensation, Nominating & Governance Other Public Company Directorships: Coinbase Global, Inc. Former Public Company Directorships Held in the Past Five Years: Hewlett Packard Enterprise Company Education: University of Illinois at Urbana-Champaign (B.S. in computer science) | ||||||

Qualifications: We believe that Mr. Andreessen should serve as a member of our board of directors due to his extensive leadership and business experience as an internet entrepreneur, venture capitalist, and technologist, as well as his service on other public and numerous private boards of directors. | ||||||||

Andrew W. Houston - Independent Director | ||||||||

Director Since: 2020 Age: 38 | Experience: Dropbox, Inc. (global collaboration platform) Chief Executive Officer & Chairman of the board of directors (2007-present) | Facebook Committees: Compensation, Nominating & Governance Other Public Company Directorships: Dropbox, Inc. Former Public Company Directorships Held in the Past Five Years: None Education: Massachusetts Institute of Technology (B.S. in electrical engineering and computer science) | ||||||

Qualifications: We believe that Mr. Houston should serve as a member of our board of directors due to his extensive leadership, entrepreneurship, and business experience as chief executive officer of a large technology company, as well as his experience with product innovation and development. | ||||||||

Nancy Killefer - Independent Director | ||||||||

Director Since: 2020 Age: 67 | Experience: McKinsey & Company (international management consulting firm) Senior Partner (1992-2013) Governing Board Member (2000-2006 and 2007-2013) Head and Founder of global public sector practice (2005-2012) Head of Washington, D.C. office (2000-2007) Various other positions (1979-1992) U.S. Department of the Treasury Assistant Secretary for Management, Chief Financial Officer & Chief Operating Officer (1997-2000) IRS Oversight Board Member (2000-2005) Chair (2002-2004) | Facebook Committees: Audit & Risk Oversight Privacy (Chair) Other Public Company Directorships: Cardinal Health, Inc. Natura & Company Former Public Company Directorships Held in the Past Five Years: The Advisory Board Company Avon Products, Inc. CSRA, Inc. Taubman Centers, Inc. Education: Vassar College (B.A. in economics) Massachusetts Institute of Technology (M.S.M. in finance) | ||||||

Qualifications: We believe that Ms. Killefer should serve as a member of our board of directors due to her extensive leadership and compliance experience in both the public and private sector, as well as her finance experience and extensive service on other boards of directors. | ||||||||

Robert M. Kimmitt - Lead Independent Director | ||||||||

Director Since: 2020 Age: 73 | Experience: Wilmer Cutler Pickering Hale and Dorr LLP (international law firm) Senior International Counsel (2009-present) U.S. Department of the Treasury Deputy Secretary (2005-2009) General Counsel (1985-1987) Time Warner Inc. Executive Vice President of Global Public Policy (2001-2005) Commerce One Vice Chairman & President (2000-2001) Wilmer Cutler & Pickering Partner (1997-2000) Lehman Brothers Managing Director (1993-1997) United States Ambassador to Germany (1991-1993) Under Secretary of State for Political Affairs (1989-1991) Sidley & Austin LLP Partner (1987-1989) National Security Council Executive Secretary & General Counsel (1983-1985) | Facebook Committees: Privacy Other Public Company Directorships: None Former Public Company Directorships Held in the Past Five Years: Deutsche Lufthansa AG Education: United States Military Academy at West Point (B.S.) Georgetown University Law Center (J.D.) Military Service: Ambassador Kimmitt is a decorated combat veteran of the Vietnam War and attained the rank of Major General in the U.S. Army Reserve | ||||||

Qualifications: We believe that Ambassador Kimmitt should serve as a member of our board of directors due to his distinguished public service and experience with legal, regulatory, compliance, and public policy issues, his finance experience, and his extensive private and public sector leadership, including service on other boards of directors. | ||||||||

Peter A. Thiel - Independent Director | ||||||||

Director Since: 2005 Age: 53 | Experience: Thiel Capital (investment firm) President (2011-present) Founders Fund (venture capital firm) Partner (2005-present) PayPal, Inc. Co-founder (1998-2002) Chief Executive Officer, President & Chairman (2000-2002) | Facebook Committees: Compensation, Nominating & Governance (Chair) Other Public Company Directorships: Palantir Technologies Inc. AbCellera Biologics Inc. Former Public Company Directorships Held in the Past Five Years: None Education: Stanford University (B.A. in philosophy) Stanford Law School (J.D.) | ||||||

Qualifications: We believe that Mr. Thiel should serve as a member of our board of directors due to his extensive leadership and business experience as an entrepreneur and venture capitalist, as well as his role as one of our early investors and longest-serving directors and service on other boards of directors. Mr. Thiel also has experience with technology and product innovation. | ||||||||

Tracey T. Travis - Independent Director | ||||||||

Director Since: 2020 Age: 58 | Experience: The Estée Lauder Companies Inc. (manufacturer and marketer of skin care, makeup, fragrance, and hair care products) Executive Vice President & Chief Financial Officer (2012-present) Ralph Lauren Corporation Senior Vice President & Chief Financial Officer (2005-2012) Limited Brands Senior Vice President of Finance (2002-2004) Intimate Brands Inc. Chief Financial Officer (2001-2002) Americas Group of American National Can Group, Inc. Chief Financial Officer (1999-2001) PepsiCo/Pepsi Bottling Group Various positions (1989-1999) | Facebook Committees: Audit & Risk Oversight (Chair) Other Public Company Directorships: Accenture plc Former Public Company Directorships Held in the Past Five Years: Campbell Soup Company Education: University of Pittsburgh (B.S.E. in industrial engineering) Columbia University (M.B.A. in finance and operations) | ||||||

Qualifications: We believe that Ms. Travis should serve as a member of our board of directors due to her extensive leadership and business experience, including service on other boards of directors, as well as her experience with finance and consumer products. | ||||||||

EXECUTIVE OFFICERS

David M. Wehner - Chief Financial Officer | ||||||||

Age: 52 | Experience: Facebook, Inc. Chief Financial Officer (2014-present) Vice President, Corporate Finance and Business Planning (2012-2014) Zynga Inc. Chief Financial Officer (2010-2012) Allen & Company Managing Director (2006-2010) Director (2005-2006) Various other positions (2001-2005) | Other Public Company Directorships: Alector, Inc. Former Public Company Directorships Held in the Past Five Years: None Education: Georgetown University (B.S. in chemistry) Stanford University (M.S. in applied physics) | ||||||

Mike Schroepfer - Chief Technology Officer | ||||||||

Age: 46 | Experience: Facebook, Inc. Chief Technology Officer (2013-present) Various other positions (2008-2013) Mozilla Corporation Vice President of Engineering (2005-2008) Sun Microsystems, Inc. Various positions, including Chief Technology Officer of its data center automation division (2003-2004) CenterRun, Inc. Co-founder (2000-2003) | Other Public Company Directorships: None Former Public Company Directorships Held in the Past Five Years: None Education: Stanford University (B.S. and M.S. in computer science) | ||||||

Christopher K. Cox - Chief Product Officer | ||||||||

Age: 38 | Experience: Facebook, Inc. Chief Product Officer (2014-2019 and 2020-present) Vice President, Product (2009-2014) Various other positions (2005-2009) | Other Public Company Directorships: None Former Public Company Directorships Held in the Past Five Years: None Education: Stanford University (B.S. in symbolic systems with a concentration in artificial intelligence) | ||||||

David B. Fischer - Chief Revenue Officer | ||||||||

Age: 48 | Experience: Facebook, Inc. Chief Revenue Officer (2019-present) Vice President, Business and Marketing Partnerships (2012-2019) Various other positions (2010-2012) Google, Inc. Various positions, including Vice President, Global Online Sales & Operations (2002-2010) U.S. Department of the Treasury Various positions, including Deputy Chief of Staff (1997-2000) U.S. News & World Report, L.P. Various positions, including Associate Editor (1994-1997) | Other Public Company Directorships: None Former Public Company Directorships Held in the Past Five Years: None Education: Cornell University (B.A. in government) Stanford University Graduate School of Business (M.B.A.) | ||||||

Jennifer G. Newstead - Vice President and General Counsel | ||||||||

Age: 51 | Experience: Facebook, Inc. Vice President & General Counsel (2019-present) U.S. Department of State Legal Adviser (2018-2019) Davis Polk & Wardwell LLP (international law firm) Partner (2006-2018) Office of Management and Budget General Counsel (2003-2005) White House Special Assistant to the President and Associate White House Counsel (2002-2003) U.S. Department of Justice Principal Deputy Assistant Attorney General of the Office of Legal Policy (2001-2002) | Other Public Company Directorships: None Former Public Company Directorships Held in the Past Five Years: None Education: Harvard University (A.B. in government) Yale Law School (J.D.) Judiciary and Academic Experience: Ms. Newstead previously served as a law clerk for Justice Stephen Breyer of the United States Supreme Court and Judge Laurence Silberman of the U.S. Court of Appeals for the D.C. Circuit, and as an Adjunct Professor of Law at Georgetown University Law Center | ||||||

Corporate Governance

BOARD OF DIRECTORS

Our board of directors may establish the authorized number of directors from time to time by resolution. The current authorized number of directors is nine. Each of our director nominees, if elected, will serve as a director until the next annual meeting of shareholders and until his or her successor has been elected and qualified, or until his or her earlier death, resignation, or removal.

Lead Independent Director Ambassador Kimmitt has significant responsibilities as our Lead Independent Director, including working with the Chairman to set agendas for meetings of our board of directors and having authority to call special meetings of our board of directors. | Independent Nominations Our independent compensation, nominating & governance committee has sole authority to recommend nominees to our board of directors and recommend the appointment of candidates to our privacy committee. | |||||||||||||||||||

Board Leadership and Independence Highlights | ||||||||||||||||||||

Board Independence Seven out of our nine director nominees are independent. All members of our standing committees are independent. | Executive Sessions Independent directors regularly meet in executive sessions, which are led by our Lead Independent Director without management present. | Board Tenure Five out of seven of our independent directors have a tenure of less than five years. | ||||||||||||||||||

BOARD MEETINGS

Our board of directors held 15 meetings during 2020. In 2020, no incumbent member of our board of directors attended fewer than 75% of the aggregate of (i) the total number of meetings of the board of directors (held during the period for which he or she was a director) and (ii) the total number of meetings held by all committees of the board of directors on which such director served (held during the period that such director served). Members of our board of directors are invited and encouraged to attend each annual meeting of shareholders. Six directors attended our 2020 Annual Meeting of Shareholders.

Generally, each regular meeting of our board of directors includes an executive session of our independent directors without management present. Executive sessions and separate meetings of the independent directors are also held from time to time, as needed. As more fully described below, our Lead Independent Director presides at executive sessions and separate meetings of the independent directors.

BOARD LEADERSHIP STRUCTURE

We believe that our current board structure is effective in supporting strong board leadership. The board of directors does not require the separation of the offices of Chair and CEO. However, when the positions of Chair and CEO are held by the same person, as is currently the case with Mr. Zuckerberg, our corporate governance guidelines provide that the independent directors shall designate a Lead Independent Director. Our Lead Independent Director is appointed annually by our independent directors, and Ambassador Kimmitt currently serves in this role.

As Chairman of our board of directors, Mr. Zuckerberg presides over meetings of the board of directors. Mr. Zuckerberg brings valuable insight to our board of directors due to his perspective and experience as our founder and CEO. As a result of his leadership since our inception, Mr. Zuckerberg has unparalleled knowledge of our business, products, and operations. As our largest and controlling shareholder, Mr. Zuckerberg is also invested in our long-term success.

As our Lead Independent Director, Ambassador Kimmitt provides independent oversight and promotes effective communication between our board of directors and management, including Mr. Zuckerberg. Ambassador Kimmitt brings extensive governance, legal, and compliance experience, and plays a significant and meaningful role in leading our board of directors.

The Chairman and the Lead Independent Director work together to set the agenda for meetings of the board of directors, and either may call special meetings of the board of directors. As more fully described in our corporate governance guidelines, our Lead Independent Director role also includes the following authority and responsibilities, among others:

•presiding at all meetings of the board of directors at which the Chairman is not present, including executive sessions of the independent directors;

•calling separate meetings of the independent directors;

•facilitating discussion and open dialogue among the independent directors during meetings of the board of directors, executive sessions, and otherwise;

•serving as principal liaison between the independent directors and the Chairman;

•providing the Chairman with feedback and counsel concerning his interactions with the board of directors;

•providing leadership to the board of directors if circumstances arise in which the role of the Chairman may be, or may be perceived to be, in conflict;

•taking into account input from other independent directors in coordinating with the Chairman to set the agenda for meetings of the board of directors; and

•leading our board of directors in governance matters in coordination with our compensation, nominating & governance committee, including the evaluation of the performance of the CEO, the selection of committee chairs and memberships, and our annual board of directors and committee self-evaluations.

Our Lead Independent Director also performs such additional duties as the board of directors may otherwise determine and delegate.

CONTROLLED COMPANY STATUS

Because Mr. Zuckerberg controls a majority of our outstanding voting power, we are a "controlled company" under the corporate governance rules of The Nasdaq Stock Market LLC (Nasdaq). Therefore, we are not required to have a majority of our board of directors be independent, nor are we required to have a compensation committee or an independent nominating function. We have nevertheless opted to have a majority of our board of directors be independent and to have a compensation, nominating & governance committee comprised of independent directors, as more fully described below.

DIRECTOR INDEPENDENCE

The rules of Nasdaq generally require that a majority of the members of a listed company's board of directors be independent. In addition, the Nasdaq rules generally require that, subject to specified exceptions, each member of a listed company's audit, compensation, and nominating committees be independent. Although we are a "controlled company" under the corporate governance rules of Nasdaq and, therefore, are not required to comply with certain rules requiring director independence, we have nevertheless opted, under our corporate governance guidelines, to have a majority of the members of our board of directors be independent.

On at least an annual basis, our compensation, nominating & governance committee reviews the independence of our non-employee directors and makes recommendations to the full board of directors. Based, in part, on the recommendations of the compensation, nominating & governance committee, our board of directors has determined that none of our current non-employee directors has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is "independent" as that term is defined under the rules of Nasdaq. In addition, our board of directors determined that Kenneth I. Chenault and Jeffrey D. Zients were each independent during the time that they served as directors in 2020.

Our board of directors has also determined that Mses. Alford, Killefer, and Travis, who comprise our audit & risk oversight committee, and Messrs. Andreessen, Houston, and Thiel, who comprise our compensation, nominating & governance committee, satisfy the respective independence standards for those committees established by applicable Securities and Exchange Commission (SEC) rules and Nasdaq rules. With respect to the independence of Ms. Alford, Mr. Andreessen, Mr. Houston, and Ms. Travis, our board of directors considered that PayPal Holdings, Inc. (PayPal), of which Ms. Alford is Executive Vice President, Global Sales; Coinbase Global, Inc. (Coinbase), of which Mr. Andreessen is a member of the board of directors and may be deemed a significant shareholder through Andreessen Horowitz, a venture capital firm affiliated with Mr. Andreessen; OfferUp, Inc., of which Mr. Andreessen may have been deemed a significant shareholder through Andreessen Horowitz in 2020; Dropbox, Inc. (Dropbox), of which Mr. Houston is Chief Executive Officer and Chairman of the board of directors; and The Estée Lauder Companies Inc., of which Ms. Travis is Executive Vice President and Chief Financial Officer, purchased and in some cases received credits to purchase advertising from us in the ordinary course of business pursuant to

our standard terms and conditions, including through a competitive bid auction. Our board of directors also considered that we made payments to PayPal and Dropbox for services relating to payment processing and data storage, respectively, in the ordinary course of business pursuant to standard terms and conditions. Our board of directors also considered that Coinbase and Andreessen Horowitz are members of the Diem Association, of which Facebook is also a member. With regard to Ms. Alford, Mr. Andreessen, Mr. Houston, and Ms. Travis, our board of directors determined that such arrangements, transactions, or relationships do not interfere with the exercise of independent judgment by these directors in carrying out their responsibilities as our directors.

Additionally with respect to Ms. Alford, our board of directors considered that she served as Chief Financial Officer and Head of Operations for the Chan Zuckerberg Initiative for approximately 18 months prior to joining our board of directors in 2019. Our board of directors determined that this prior affiliation with the Chan Zuckerberg Initiative does not interfere with Ms. Alford's exercise of independent judgment in carrying out her responsibilities as a director based on the short term of her service to such organization and her conduct as a director to date.

In addition, our board of directors considered that Ambassador Kimmitt is senior international counsel at the law firm of Wilmer Cutler Pickering Hale and Dorr LLP (WilmerHale), an international law firm based in Washington, D.C. From time to time and in the ordinary course of its business, WilmerHale provides legal services to Facebook amounting to less than 5% of WilmerHale's total revenue in 2020. Ambassador Kimmitt has only provided de minimis legal services to Facebook over the past three years and has not provided any such services during his term as a director. Ambassador Kimmitt is not an equity partner in the firm and does not receive any compensation from the firm that is generated by or related to our payments to WilmerHale for such services. In addition, WilmerHale has agreed to implement certain measures to help ensure that Ambassador Kimmitt is walled off from any legal representation of Facebook undertaken by WilmerHale. Further, our compensation, nominating & governance committee reviewed the nature of Facebook's engagement of WilmerHale and the services rendered, including the expertise and relevant experience of the firm and the specific partners engaged to work on the matters for which we have engaged the firm, and determined that Ambassador Kimmitt's service on our board should not impair our company's ability to engage WilmerHale when our company determines such engagements to be appropriate and in our best interests. Our compensation, nominating & governance committee is satisfied that WilmerHale, when engaged for legal work, is chosen by our company's legal group on the basis of the directly relevant factors of experience, expertise, and efficiency. After taking into account all relevant facts and circumstances, our board of directors determined that Facebook's professional engagement of WilmerHale does not interfere with Ambassador Kimmitt's exercise of independent judgment in carrying out his responsibilities as a director.

CLASSIFIED BOARD

So long as the outstanding shares of our Class B common stock represent a majority of the combined voting power of our outstanding common stock, we will not have a classified board of directors, and all directors will be elected for annual terms. As of the close of business on April 1, 2021, the outstanding shares of our Class B common stock represented a majority of the combined voting power of our outstanding common stock.

However, our restated certificate of incorporation and our amended and restated bylaws provide that when the outstanding shares of our Class B common stock represent less than a majority of the combined voting power of our outstanding common stock, we will have a classified board of directors consisting of three classes of approximately equal size, each serving staggered three-year terms. At such time, our directors will be assigned by the then-current board of directors to a class. Upon expiration of the term of a class of directors, directors for that class will be elected for three-year terms at the annual meeting of shareholders in the year in which that term expires. As a result, only one class of directors will be elected at each annual meeting of our shareholders, with the other classes continuing for the remainder of their respective three-year terms. Each director's term continues until the next annual meeting of shareholders and until his or her successor has been elected and qualified, or until his or her earlier death, resignation, or removal.

In addition, when the outstanding shares of our Class B common stock represent less than a majority of the combined voting power of our outstanding common stock and we have a classified board, only our board of directors may fill vacancies on our board. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the total number of directors.

The classification of our board of directors, if implemented, may have the effect of delaying or preventing changes in our control or management.

INDEPENDENT BOARD OVERSIGHT

All of the standing committees of our board of directors are comprised of independent directors, we have a Lead Independent Director who has authority that mirrors that of the Chairman, including coordinating board meeting agendas and the ability to

call special meetings of the board of directors, and the board of directors also establishes ad hoc special committees of independent directors from time to time, as appropriate.

The compensation, nominating & governance committee reviews and approves the compensation of our chief executive officer, including perquisites related to executive security, and the performance of our chief executive officer is evaluated by the independent directors. Our Lead Independent Director provides our chief executive officer with feedback regarding his performance and also meets with the chief executive officer after each regular board of directors meeting to review the meeting and share perspectives from the independent directors.

BOARD COMMITTEES

Our board of directors has established an audit & risk oversight committee, a compensation, nominating & governance committee, and a privacy committee, each of which has the composition and responsibilities described below. Members serve on these committees until their resignations or until otherwise determined by our board of directors. Our board of directors has adopted a written charter for each of these committees, which are available on our website at http://investor.fb.com/governance.cfm.

The following table provides information regarding the current composition of our standing committees:

| Director | Audit & Risk Oversight Committee(1) | Compensation, Nominating & Governance Committee(2) | Privacy Committee(3) | |||||||||||||||||

| Peggy Alford | ||||||||||||||||||||

| Marc L. Andreessen | ||||||||||||||||||||

| Andrew W. Houston | ||||||||||||||||||||

| Nancy Killefer | ||||||||||||||||||||

| Robert M. Kimmitt | ||||||||||||||||||||

| Sheryl K. Sandberg | ||||||||||||||||||||

| Peter A. Thiel | ||||||||||||||||||||

| Tracey T. Travis | ||||||||||||||||||||

| Mark Zuckerberg | ||||||||||||||||||||

(1)In 2020, Kenneth I. Chenault and Jeffrey D. Zients served on our audit & risk oversight committee until May 2020, and Marc L. Andreessen served on our audit & risk oversight committee until February 2021. Nancy Killefer was appointed to our audit & risk oversight committee in February 2021.

(2)Andrew W. Houston was appointed to our compensation, nominating & governance committee in April 2020.

(3)Our board of directors formed our privacy committee in May 2020.

From time to time, the board of directors may also establish ad hoc committees to address particular matters. For example, in April 2019, our board of directors established a special committee of independent directors to oversee the process involving the inquiry by the U.S. Federal Trade Commission (FTC) into our compliance with our existing FTC consent order. Following our July 2019 settlement and entry into a modified FTC consent order, this special committee continued to oversee our efforts to prepare for implementation of the requirements of the modified consent order. This special committee was comprised of Messrs. Andreessen, Chenault, and Zients and held one meeting in 2020.

AUDIT & RISK OVERSIGHT COMMITTEE | ||||||||

Chair: Tracey T. Travis Other Members: Peggy Alford Nancy Killefer Committee Meetings in 2020: 9 | Principal Responsibilities •Selecting the independent registered public accounting firm to audit our financial statements •Ensuring the independence of the independent registered public accounting firm •Discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and that firm, our interim and year-end operating results •Developing procedures to enable submission of anonymous concerns about accounting or auditing matters •Considering the adequacy of our internal accounting controls and audit procedures •Reviewing related party transactions •Reviewing our program for promoting and monitoring compliance with applicable legal and regulatory requirements •Overseeing our major risk exposures (including in the areas of financial and enterprise risk, legal and regulatory compliance, environmental sustainability, social responsibility, and cybersecurity) and the steps management has taken to monitor and control such exposures, and assisting our board of directors in overseeing the risk management of our company •Pre-approving all audit and non-audit services to be performed by the independent registered public accounting firm •Overseeing our internal audit function Independence and Other Qualifications •Each committee member satisfies the independence standards for audit committees established by applicable SEC rules and Nasdaq rules. •Ms. Travis qualifies as an audit committee financial expert, as that term is defined under SEC rules, and possesses financial sophistication as defined under Nasdaq rules. | |||||||

COMPENSATION, NOMINATING & GOVERNANCE COMMITTEE | ||||||||

Chair: Peter A. Thiel Other Members: Marc L. Andreessen Andrew W. Houston Committee Meetings in 2020: 11 | Principal Responsibilities •Evaluating the performance of our executive officers •Evaluating, recommending, approving and reviewing executive officer compensation arrangements, plans, policies and programs maintained by us •Administering our equity-based compensation plans and our annual bonus plan •Considering and making recommendations regarding non-employee director compensation •Considering and making recommendations to our board of directors regarding its remaining responsibilities relating to executive compensation •Reviewing and developing policies regarding the desired knowledge, experience, skills, diversity, independence, and other characteristics of members of our board of directors and its committees, as well as our director nomination and committee appointment processes •Identifying, evaluating, and recommending potential candidates for nomination to and membership on our board of directors and certain of its committees, including having sole authority to recommend nominees to our board of directors •Having sole authority to recommend the appointment of candidates to, or removal of members from, our privacy committee •Monitoring succession planning for our board of directors and certain of our key executives •Developing and recommending corporate governance guidelines and policies •Overseeing the annual self-evaluation process for our board of directors and committees thereof •Reviewing and granting proposed waivers of the code of conduct for executive officers •Advising our board of directors on corporate governance matters and board of director performance matters, including recommendations regarding the size, structure, and composition of our board of directors and committees thereof Independence and Other Qualifications •Each committee member satisfies the independence standards for compensation committees established by applicable SEC rules and Nasdaq rules, and otherwise meets the independence requirements under our FTC consent order. •Each committee member is a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act. | |||||||

The charter for our compensation, nominating & governance committee allows the committee from time to time to delegate its authority to subcommittees and to our officers, as it may be deemed necessary or appropriate and to the extent permitted under applicable law, SEC and Nasdaq rules, and our certificate of incorporation and bylaws. In December 2013, our compensation committee (which was a predecessor to our compensation, nominating & governance committee) authorized the formation and delegation of certain authority to an equity subcommittee, which is now a subcommittee of the compensation, nominating & governance committee. The current members of the equity subcommittee are Ms. Sandberg and Mr. Wehner, and the members, acting either individually or jointly, have the authority to review and approve grants of restricted stock units (RSUs) to employees and consultants, other than to directors and our executive officers, which are reviewed and approved by our compensation, nominating & governance committee. The compensation, nominating & governance committee has not adopted a written charter for the equity subcommittee.

PRIVACY COMMITTEE | ||||||||

Chair: Nancy Killefer Other Members: Peggy Alford Robert M. Kimmitt Committee Meetings in 2020: 4 | Principal Responsibilities •Overseeing our comprehensive privacy program adopted in compliance with our FTC consent order •Overseeing management's periodic assessment of the privacy program and any related policies with respect to risk assessment and risk management •Overseeing the selection and performance of employees to coordinate and be responsible for the privacy program •Overseeing the selection of an independent, third-party assessor to review our privacy practices, as well as the assessor's biennial assessments of the privacy program Independence and Other Qualifications •Each committee member is an independent director under Nasdaq rules, and otherwise meets the independence requirements under our FTC consent order. •Our compensation, nominating & governance committee has recommended the appointment of each member to the privacy committee and determined that each such member meets the privacy and compliance baseline requirements for committee membership under our FTC consent order. | |||||||

POLICY REGARDING NOMINATIONS

The policy of our board of directors is to encourage the selection of directors who will contribute to Facebook's success and our mission to give people the power to build community and bring the world closer together. Our compensation, nominating & governance committee is responsible for identifying and evaluating candidates for membership on our board of directors, based on the criteria set forth in our corporate governance guidelines, and has sole authority to recommend nominees to our board of directors. The compensation, nominating & governance committee considers recommendations from other directors, shareholders, management, and others as it deems appropriate and uses the same criteria for evaluating candidates regardless of the source of the recommendation. Our board of directors is responsible for nominating persons for election to our board of directors upon the recommendation of our compensation, nominating & governance committee, and may not nominate any person for election without the prior favorable recommendation of our compensation, nominating & governance committee.

Shareholders who would like to recommend director candidates for consideration by our compensation, nominating & governance committee should send a notice of proposal to our Secretary by writing the Secretary at the address of our principal executive offices. Shareholders desiring to nominate a director candidate at the annual meeting must comply with other procedures in accordance with our bylaws. We explain the procedures for nominating a director candidate at next year's annual meeting in the section entitled "Questions and Answers About the Proxy Materials and the Annual Meeting—How can I make proposals or make a nomination for director for next year's annual meeting?"

BOARD DIVERSITY POLICY

Facebook is committed to a policy of inclusiveness and to pursuing diversity in terms of background and perspective. As such, when evaluating candidates for nomination as new directors, it is the policy of our compensation, nominating & governance committee to consider candidates with diverse backgrounds in terms of knowledge, experience, skills, and other characteristics. To this end, Facebook was one of the first major companies to amend its corporate governance guidelines to provide that the initial list of candidates from which new director nominees are chosen by the board shall include candidates with a diversity of race, ethnicity, and gender. In evaluating potential candidates for nomination, our compensation, nominating & governance committee considers the foregoing in light of the specific needs of the board of directors at that time. In addition,

our compensation, nominating & governance committee considers director tenure in connection with evaluating current directors for nomination for re-election.

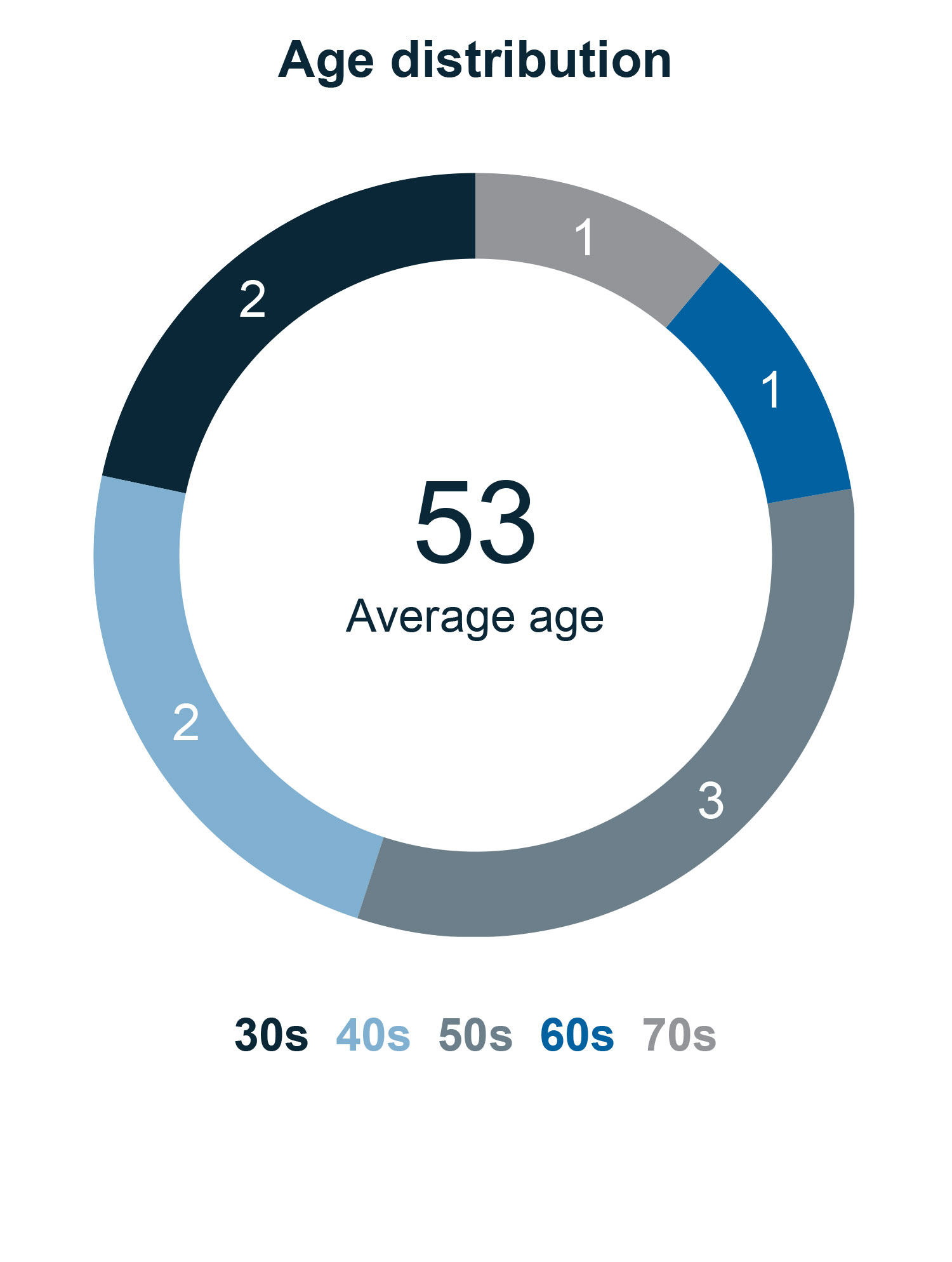

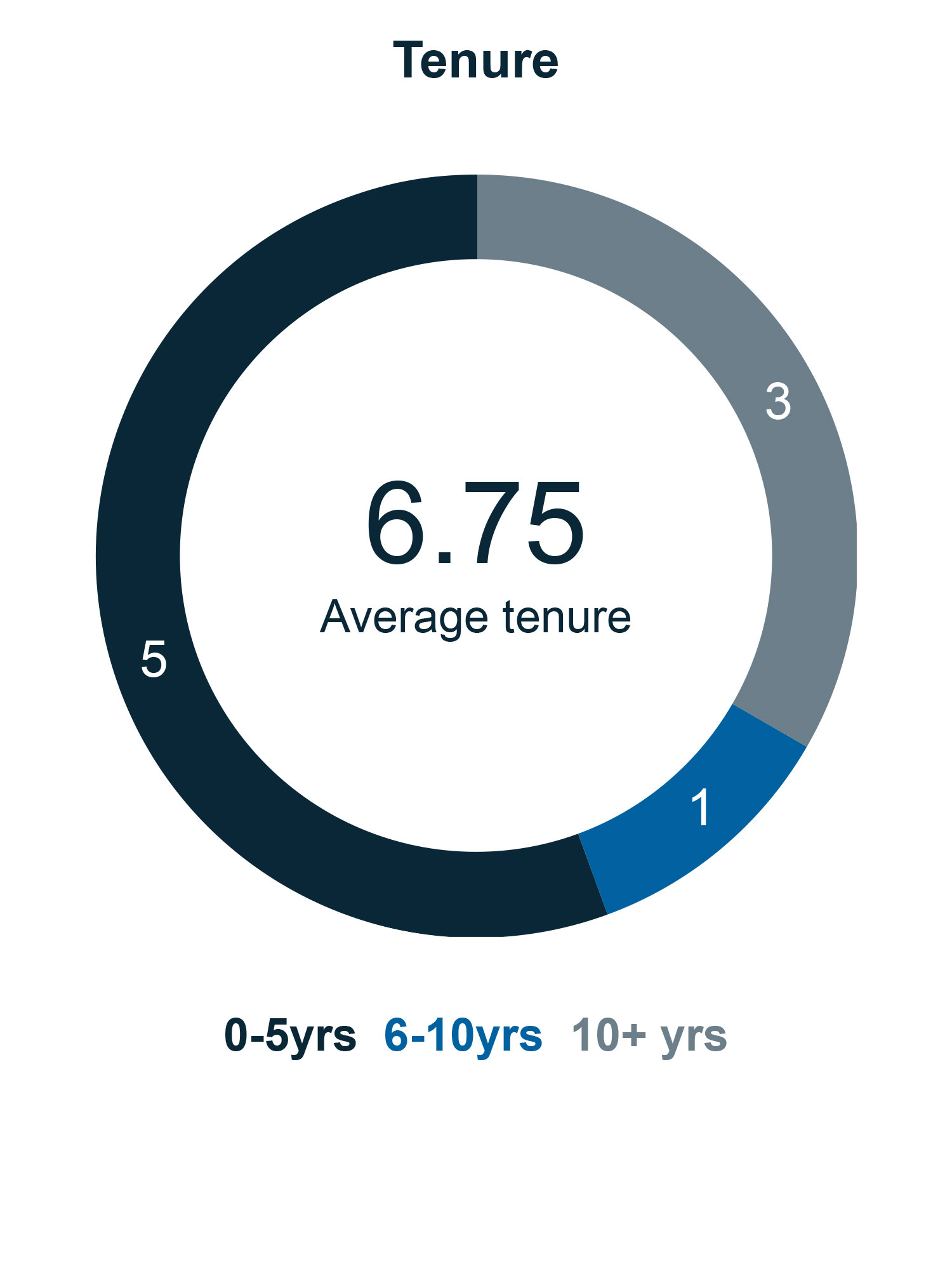

BOARD COMPOSITION

Our board of directors believes that its composition appropriately reflects the knowledge, experience, skills, diversity, and other characteristics required to fulfill its duties. The following tables provide information regarding the diversity, age, and tenure of our nominees for election at the Annual Meeting:

The current director nominees have diverse backgrounds and perspectives that enable them to provide valuable guidance on both strategic and operational issues. Our nominees have extensive leadership and compliance experience, as well as corporate governance expertise arising from service on other boards of directors. Many of our nominees have global business experience, including through service as CEO or in other senior corporate leadership positions involving management of complex operations, business challenges, risks, and growth. Several nominees have experience with technology or product innovation and development, entrepreneurship, and the dynamics of our industry. Other nominees have significant public sector experience from serving in high-level government positions, including experience with significant regulatory and public policy issues. Our nominees also have a demonstrated sense of social mission, having contributed to social causes through nonprofit organizations and/or philanthropy. Our board of directors benefits from these qualifications, as well as the perspectives of nominees with in-depth knowledge of our company through their service as executive officers. The skills and qualifications of our director nominees are more fully described below.

| DIRECTOR SKILLS AND QUALIFICATIONS | |||||

| Peggy Alford | •Global business, leadership, and compliance experience in both operational and financial oversight roles, as well as experience with technology, product development, and the dynamics of our industry, as Executive Vice President, Global Sales at PayPal Holdings, Inc. and through prior service in senior leadership positions at PayPal, eBay Inc., and Rent.com, an eBay company •Outside board experience as a director of The Macerich Company | ||||

| Marc L. Andreessen | •Finance and investment expertise, as well as experience with technology and the dynamics of our industry, as co-founder and General Partner of Andreessen Horowitz •Extensive leadership, business, technology, and entrepreneurship experience through prior service as co-founder and Chairman of the board of directors of Opsware, Inc. (formerly known as Loudcloud Inc.), Chief Technology Officer of America Online, Inc., and co-founder of, and service in senior leadership positions at, Netscape Communications Corporation, including as Chief Technology Officer and Executive Vice President of Products •Outside board experience as a director of Coinbase Global, Inc. and numerous private companies, as well as prior service as a director of eBay Inc., Hewlett-Packard Company, and Hewlett Packard Enterprise Company | ||||

| Andrew W. Houston | •Extensive leadership, entrepreneurship, business, technology, and product innovation and development experience, as well as experience with the dynamics of our industry, as Chief Executive Officer of Dropbox, Inc. •Outside board experience as Chairman of the board of directors of Dropbox | ||||

| Nancy Killefer | •Extensive leadership, business, and compliance experience through prior service as Senior Partner and in other leadership roles at McKinsey & Company, an international management consulting firm, including as a member of the firm's governing board •Prior service in senior U.S. government roles, including as Assistant Secretary for Management, Chief Financial Officer, and Chief Operating Officer of the U.S. Department of the Treasury and as Chair of the IRS Oversight Board •Outside board experience as a director of Cardinal Health, Inc. and Natura & Company, as well as prior service as a director of the Advisory Board Company, Avon Products, Inc., Computer Sciences Corporation, CSRA, Inc., and Taubman Centers, Inc. | ||||

| Robert M. Kimmitt | •Legal and compliance experience as Senior International Counsel at Wilmer Cutler Pickering Hale and Dorr LLP, and prior service as partner at Wilmer Cutler & Pickering and Sidley & Austin LLP •Prior service in senior U.S. government roles, including experience with privacy issues, as Deputy Secretary of the Treasury, United States Ambassador to Germany, Under Secretary of State for Political Affairs, General Counsel for the U.S. Department of the Treasury, and National Security Council Executive Secretary and General Counsel •Global business, leadership, policy, and finance experience, including through prior service as Executive Vice President of Global Public Policy at Time Warner Inc., Vice Chairman and President of Commerce One, and managing director at Lehman Brothers •Outside board experience through prior service as a director of Deutsche Lufthansa AG, Commerce One, Inc., Siemens AG, United Defense Industries, Inc., and Big Flower Press Holdings, Inc. | ||||

| Sheryl K. Sandberg | •Extensive leadership, global business, technology, and product development experience, as well as in-depth knowledge of our company and experience with the dynamics of our industry, through service as our Chief Operating Officer •Global business, leadership, and finance experience through prior service as Vice President, Global Online Sales & Operations at Google, Inc., a consultant with McKinsey & Company, and an economist with The World Bank •Prior service in U.S. government as a Chief of Staff of the U.S. Department of the Treasury and Senior Advisor to the Deputy Secretary of the Treasury •Outside board experience as a director of SurveyMonkey (SVMK Inc.) and prior service as a director of Starbucks Corporation and the Walt Disney Company | ||||

| Peter A. Thiel | •Finance and investment expertise, as well as experience with technology and the dynamics of our industry, as President of Thiel Capital and Partner of Founders Fund •Extensive leadership, business, technology, entrepreneurship, and product innovation experience as co-founder of Palantir Technologies Inc. and through prior service as co-founder, Chief Executive Officer, and President of PayPal, Inc. •Outside board experience as Chairman of the board of directors of Palantir, a director of AbCellera Biologics Inc. and several private companies, and prior service as Chairman of the board of directors of PayPal | ||||

| Tracey T. Travis | •Global business and extensive financial experience as Executive Vice President and Chief Financial Officer of The Estée Lauder Companies Inc., as well as prior service as Senior Vice President and Chief Financial Officer of Ralph Lauren Corporation and in senior finance leadership positions at Limited Brands, Intimate Brands Inc., and Americas Group of American National Can Group, Inc. •Outside board experience as a director of Accenture plc, as well as prior service as a director of Campbell Soup Company | ||||

| Mark Zuckerberg | •Extensive leadership, entrepreneurship, global business, technology, and product innovation and development experience, as well as in-depth knowledge of our company and experience with the dynamics of our industry, through service as our Founder, Chief Executive Officer, and Chairman of our board of directors | ||||

Our board of directors also believes that the current director nominees represent an effective balance with respect to director tenure. Ms. Alford joined the board of directors in 2019, and Mr. Houston, Mses. Killefer and Travis, and Ambassador Kimmitt joined the board of directors in 2020. These additions provide our board of directors with fresh perspectives and diverse experiences, while directors with longer tenure provide continuity and valuable insight into our business and strategy.

BOARD PERFORMANCE

Our board of directors conducts an annual self-assessment of the performance of the board of directors, each committee, and each director. Our compensation, nominating & governance committee, in coordination with our Lead Independent Director, oversees the self-assessment process, and the results are reported to the board of directors. Our compensation, nominating & governance committee and our board of directors also periodically review the composition of the board of directors to ensure that it appropriately reflects the knowledge, experience, skills, diversity, and other characteristics required to fulfill its duties.

DIRECTOR ORIENTATION AND EDUCATION

We provide a number of onboarding sessions for new members of our board of directors to engage with our management team and learn more about our company priorities, strategy, and operations, as well as key issues and risks facing our industry, business, and community. Our management team also regularly engages with our directors throughout the year to provide updates across these areas, including in-depth reviews of relevant issues from subject matter experts.

BOARD ROLE IN RISK OVERSIGHT

Our board of directors as a whole has responsibility for overseeing our risk management and believes that a thorough and strategic approach to risk oversight is critical. The board of directors exercises this oversight responsibility directly and through its committees. The oversight responsibility of the board of directors and its committees is informed by regular reports from our management team, including senior personnel that lead a variety of functions across the business, and from our internal audit department, as well as input from external advisors, as appropriate. These reports are designed to provide timely visibility to the board of directors and its committees about the identification and assessment of key risks, our risk mitigation strategies, and ongoing developments.

The full board of directors has primary responsibility for evaluating strategic and operational risk management, and for CEO succession planning. Our audit & risk oversight committee has responsibility for overseeing certain of our major risk exposures, including in the areas of financial and enterprise risk, legal and regulatory compliance, environmental sustainability, social responsibility, and cybersecurity, as well as risks in other areas as our audit & risk oversight committee deems necessary or appropriate from time to time. Our audit & risk oversight committee also oversees the steps we have taken to monitor or mitigate these exposures, including policies and procedures for assessing and managing risk and related compliance efforts. Our board of directors also may exercise direct oversight with respect to these areas or delegate such oversight to committees in its discretion. In addition, our audit & risk oversight committee oversees our internal audit function. Our privacy committee oversees the risks related to privacy and data use matters, including our compliance with the comprehensive privacy program that we adopted in compliance with our FTC consent order and the steps that we have taken or plan to take to monitor or mitigate such risks. Our compensation, nominating & governance committee evaluates risks arising from our corporate governance and compensation policies and practices, as more fully described in the section of this proxy statement entitled "Executive Compensation—Compensation Discussion and Analysis—Compensation Risk Assessment," and oversees succession planning for our board of directors and certain key executives other than the CEO. Each of these committees provide reports to the full board of directors regarding these and other matters.

ESG at Facebook

At Facebook, we are focused on our mission to give people the power to build community and bring the world closer together. We have ongoing efforts across environmental, social, and governance (ESG) areas to further our mission and pursue our company principles. Below we describe highlights of our ESG efforts, including resources where you can learn more. We also regularly post company updates in our Newsroom at https://about.fb.com/news/ and on Mark Zuckerberg's Facebook Page at https://www.facebook.com/zuck.

OUR PRINCIPLES Our principles are what we stand for. They are beliefs we hold deeply and we may make tradeoffs from time to time to pursue. | ||||||||||||||||||||

Give People a Voice People deserve to be heard and to have a voice—even when that means defending the right of people we disagree with. | Serve Everyone We work to make technology accessible to everyone, and our business model is ads so our services can be free. | |||||||||||||||||||

Promote Economic Opportunity Our tools help level the playing field so businesses grow, create jobs and strengthen the economy. | Build Connection and Community Our services help people connect, and when they’re at their best, they bring people closer together. | Keep People Safe and Protect Privacy We have a responsibility to promote the best of what people can do together by keeping people safe and preventing harm. | ||||||||||||||||||

GOVERNANCE

We are committed to sound corporate governance practices and encouraging effective policy and decision making at both the board of directors and management level. Our board of directors, its committees, and our management provide oversight around our efforts in many of the ESG areas described below. For example, our audit & risk oversight committee oversees our major risk exposures in the areas of environmental sustainability, social responsibility, and cybersecurity, among others, and our privacy committee oversees our privacy program and risk exposures related to privacy and data use. Our governance practices are described in more detail in the section of this proxy statement entitled “Corporate Governance.”

Governance Documents